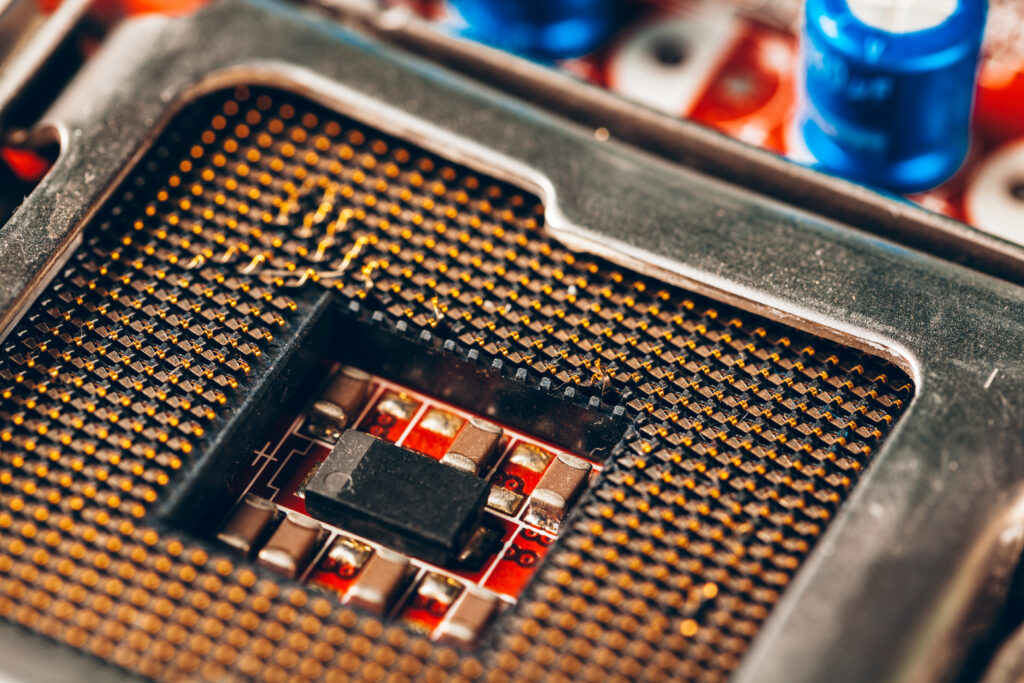

AXT Inc. (AXTI) is a leading innovator and supplier of advanced semiconductor materials that play a pivotal role in the global electronics and technology sectors. Founded in 1986, the company specializes in the production of high-performance substrates made from compounds like gallium arsenide (GaAs), indium phosphide (InP), and germanium. These materials are essential for manufacturing cutting-edge devices used in telecommunications, consumer electronics, data centers, and other advanced technological applications. AXT has built a strong reputation for providing high-quality materials that enable some of the most sophisticated electronic devices in the world.

With its headquarters in Fremont, California, AXT operates in an industry at the forefront of technological progress. The company’s substrates are crucial components in the production of high-speed communication systems, including 5G infrastructure and wireless communication devices, as well as the rapidly expanding fields of artificial intelligence (AI) and photonics. As a key player in the compound semiconductor market, AXT’s products are utilized in high-performance applications ranging from mobile devices to data centers and aerospace systems, positioning the company as a critical supplier in the semiconductor value chain.

What sets AXT apart from its competitors is its dedication to research and development, enabling the company to stay ahead of the curve in an ever-evolving industry. AXT’s technological advancements and focus on superior manufacturing processes have earned it a loyal customer base, consisting of major semiconductor manufacturers, telecommunications providers, and technology companies worldwide. By continuously refining its production methods and expanding its product offerings, AXT aims to meet the growing demand for faster, more efficient, and cost-effective semiconductor materials.

In recent years, the company has made significant strides in capitalizing on the increasing demand for semiconductors, driven by the expansion of the Internet of Things (IoT), AI, and data-driven technologies. These sectors are expected to be major growth drivers for AXT, as the company looks to leverage its expertise in compound semiconductors to supply critical materials for next-generation technologies. With a robust foundation in both the compound semiconductor market and emerging technology sectors, AXT is well-positioned to continue its growth trajectory and deliver long-term value to investors.

Whether you are an industry analyst, investor, or technology enthusiast, AXT represents a company on the cutting edge of semiconductor innovation, with the potential to shape the future of technology as we know it.

The Current State of AXT: Financial Performance and Market Reaction

Following its Q3 2024 report, AXT experienced a 22% decline in its stock price, settling at $2.11 per share. This selloff was triggered by a 9% revenue miss, with the company reporting $24 million instead of the expected $26.4 million. However, the losses per share were notably smaller than anticipated, coming in at $0.07 per share—a positive sign indicating improved cost management and operational efficiency.

While these short-term setbacks may raise concerns, the bigger picture reveals a company focused on enhancing profitability and positioning itself for the future. Analysts expect AXT to generate $110.8 million in revenue in 2025, reflecting a significant 17% increase year-over-year, with an upgraded EPS forecast of $0.39. This shift in expectations underscores a deliberate strategy to prioritize profitability over aggressive growth.

CHECK THIS OUT: Palladyne AI (PDYN) Reports $21.3M Cash Reserves to Drive Innovation in Robotics

AXT’s Role in High-Growth Sectors: AI, Data Centers, and Telecommunications

The proliferation of AI, 5G technologies, and data center expansion offers a substantial runway for AXT’s growth. Its substrates are critical components in devices that power high-speed communication and advanced computing. As AI applications expand into mainstream industries, the demand for high-performance semiconductor materials like those AXT produces will continue to rise.

Furthermore, AXT’s advancements in indium phosphide substrates place it at the center of technologies such as photonics and high-frequency applications, which are crucial for AI and next-generation telecommunications. Analysts suggest this alignment with high-growth markets could result in meaningful revenue streams over the next decade.

Earnings Upgrades: A Sign of Improved Sentiment

One of the most notable developments following AXT’s Q3 report is the significant upgrade to its EPS forecast for 2025. Previously estimated at $0.15, analysts now project $0.39 per share, suggesting stronger margins and a more efficient operational model. This increase in profitability potential is a bullish indicator, demonstrating AXT’s ability to weather short-term challenges and focus on sustainable growth.

Additionally, while revenue forecasts for 2025 have been adjusted downward to $110.8 million from $126.6 million, the company’s gross margin improvements (24.0% in Q3 2024, up from 10.7% in Q3 2023) indicate that AXT is optimizing its business to deliver shareholder value.

Industry Comparison and Growth Outlook

Despite expectations of 13% annualized growth for AXT over the next two years, this figure trails the semiconductor industry’s projected 18% annual growth. However, AXT’s historical growth of just 1.2% per year over the past five years makes the anticipated acceleration significant.

While the company’s growth rate may not match industry leaders, its niche focus on compound semiconductor substrates provides a unique competitive advantage. With increasing demand for its materials in specialized applications, AXT has the potential to carve out a larger share of the market, particularly as new technologies emerge.

Market Confidence and Valuation Insights

The consensus price target for AXT remains steady at $5.30 per share, with a narrow range of $5.00 to $6.00. This stability indicates that analysts maintain confidence in the company’s intrinsic value, despite near-term challenges. The upgraded earnings forecasts further support this sentiment, suggesting that the market is beginning to recognize the company’s long-term potential.

Long-Term Potential: A Balanced Approach to Growth and Profitability

AXT’s strategy to focus on profitability while maintaining steady revenue growth reflects a disciplined approach to value creation. By aligning its operations with high-growth industries such as AI and 5G, the company is positioning itself for sustained success. The combination of improving gross margins, rising EPS projections, and a stable market valuation underscores the company’s resilience and potential for recovery.

Why AXT, Inc. Remains a Compelling Investment Opportunity

In summary, AXT, Inc. offers a unique opportunity for investors seeking exposure to the semiconductor industry’s rapid evolution. While short-term revenue fluctuations and market selloffs may concern some, the company’s strategic focus on profitability, alignment with emerging technologies, and improving operational metrics make a compelling case for its long-term potential.

The anticipated 17% revenue growth in 2025, coupled with upgraded EPS forecasts, signals a bright future for AXT as it navigates the challenges of a competitive market. For investors looking to capitalize on the growth of AI, data centers, and next-generation telecommunications, AXT represents a promising opportunity to be part of the semiconductor revolution.

READ ALSO: Rezolute (RZLT) Ends Fiscal 2024 with $127M in Cash to Drive Clinical Innovations and Inseego Corp (INSG) Reports $61.9M Revenue in Q3 2024, Marking a Strong Financial Turnaround.